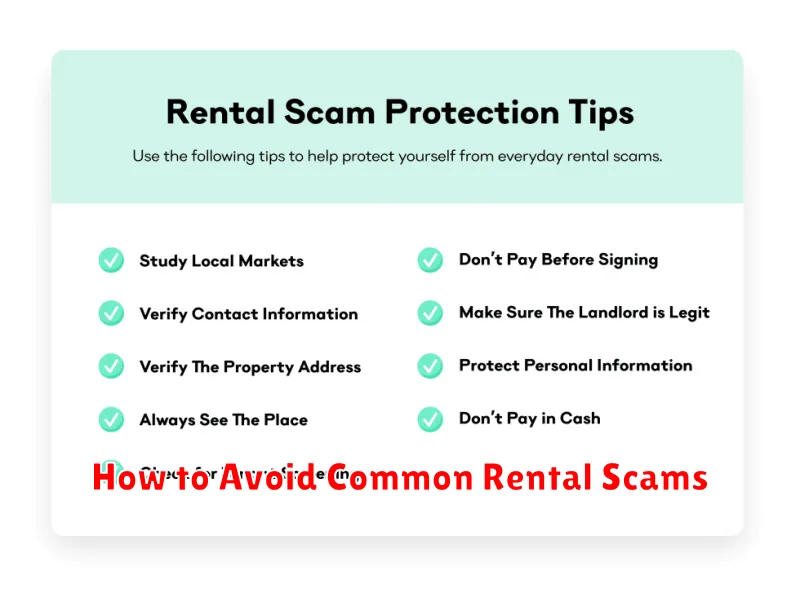

Navigating the rental market can be challenging, especially with the rise of rental scams. Protecting yourself from these fraudulent schemes is crucial. This article will provide essential information on how to avoid common rental scams, empowering you to confidently secure legitimate housing and avoid becoming a victim. We’ll explore the red flags to watch out for, including fake listings, requests for upfront payment before viewing a property, and high-pressure tactics employed by scammers. Understanding these tactics is the first step toward a safe and successful rental search.

Learning how to identify and avoid rental scams is essential for anyone seeking a new home. From verifying landlord identities to understanding legitimate rental practices, this guide offers practical advice to help you navigate the rental process safely. We will equip you with the knowledge to recognize suspicious behavior, conduct thorough property research, and ultimately make informed decisions that protect your finances and peace of mind. By being proactive and informed, you can significantly reduce your risk of encountering a rental scam.

Recognizing Fake Listings

Suspicious Pricing: Be wary of rentals priced significantly below market value. Scammers often use low prices to lure victims.

Limited Contact Information: Fake listings may provide only an email address or a generic contact form, avoiding phone calls.

Request for Upfront Payment: Be cautious of requests for wire transfers, gift cards, or cash deposits before viewing the property. Legitimate landlords typically require payment after a lease agreement is signed.

Generic Photos or Descriptions: Scammers may use photos or descriptions copied from other listings. Look for inconsistencies or overly generic language.

Pressure Tactics: Be wary of high-pressure sales tactics or demands for immediate payment due to “high demand”.

Avoiding Upfront Cash Requests

A major red flag in rental scams is the demand for upfront cash payments before a lease is signed or the property is viewed. Never send money via wire transfer, money orders, or gift cards. Legitimate landlords will typically require a security deposit and first month’s rent after a lease agreement is signed.

Be wary of requests for application fees that seem unusually high or are requested before you’ve even toured the property. Always insist on seeing the property in person and meeting the landlord or property manager before providing any financial information or payment.

Insisting on Seeing the Property First

One of the most crucial steps in avoiding rental scams is to physically inspect the property before signing any lease agreements or making payments. This allows you to confirm the property’s existence, condition, and advertised features. A scammer will often make excuses to avoid an in-person showing.

If the landlord claims they are out of town, request a showing with a local representative, such as a property manager. If they refuse or offer only a virtual tour, consider this a major red flag. Never rent a property sight unseen.

Verifying Ownership and Licenses

A crucial step in avoiding rental scams involves verifying the landlord’s ownership and required licenses. Confirm ownership by checking public property records. This helps ensure you’re dealing with the actual owner and not a scammer.

Licensing requirements vary by location. Contact your local housing authority to determine what licenses are necessary for landlords in your area. Verify that the landlord possesses these licenses. This adds another layer of protection against fraudulent listings.

Using Trusted Platforms Only

One of the most effective ways to avoid rental scams is to conduct your search using reputable platforms. Established websites and apps often have security measures in place to verify listings and users, reducing the risk of encountering fraudulent activities.

Avoid responding to listings on less-known websites or social media platforms where verification processes may be lacking. Sticking to trusted platforms offers a greater level of protection against scams.

Red Flags in Communication

High-pressure tactics are a major warning sign. If a landlord pushes you to make a decision quickly or demands immediate payment without proper documentation, be wary. This is often a tactic used by scammers to bypass due diligence.

Requests for payment outside of secure platforms are a significant red flag. Avoid wire transfers, cryptocurrency payments, or other untraceable methods. Legitimate landlords typically utilize established payment platforms.

Poor communication or inconsistencies in their story should raise concerns. If the landlord avoids answering specific questions or provides conflicting information, it’s a strong indicator of a potential scam.

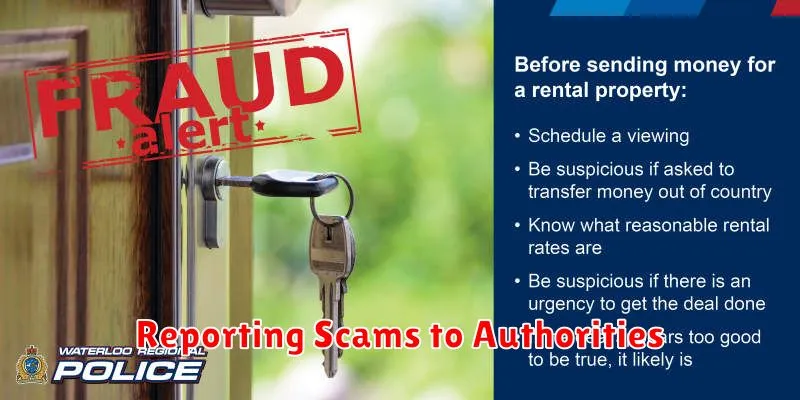

Reporting Scams to Authorities

If you encounter a rental scam, reporting it can help prevent others from becoming victims. Report the scam to the platform where you found the listing (e.g., Craigslist, Facebook Marketplace).

You should also file a report with the Federal Trade Commission (FTC). Additionally, consider contacting your local law enforcement. Providing them with all the details of the scam, including any communication and transaction information, is crucial.