Finding an apartment that fits your needs and budget can be challenging. One of the most critical steps in the apartment search process is determining how much rent you can afford. This seemingly simple question can have significant implications for your financial well-being. Failing to properly budget for rent can lead to financial stress, missed payments, and even eviction. This article will provide you with practical budgeting tips to help you determine a sustainable rent amount, enabling you to find a comfortable home without compromising your financial stability. We’ll cover key factors to consider, including your income, expenses, and savings goals, equipping you with the knowledge to make informed decisions about your housing costs.

Understanding how to calculate affordable rent is essential for both prospective and current tenants. Whether you’re just starting your apartment search or looking to reassess your current living situation, having a clear grasp of your budget is paramount. Using the 30% rule, the 50/30/20 rule, and other budgeting methods discussed in this guide will provide you with a strong foundation for managing your finances and finding the right rental property within your means. Learn how to calculate your maximum affordable rent, incorporate essential expenses, and prioritize your financial goals. With our expert advice, you can confidently navigate the rental market and secure a comfortable home without overspending.

Calculating Monthly Rent Affordability

Determining a reasonable rent amount is crucial for financial stability. The 30% rule is a common guideline, suggesting that your rent should not exceed 30% of your gross monthly income.

To calculate this, multiply your gross monthly income by 0.30. For example, if your gross monthly income is $4,000, then your affordable rent would be $4,000 x 0.30 = $1,200.

While the 30% rule is a helpful starting point, consider your individual financial obligations and spending habits for a more accurate assessment.

The 30% Rule Explained

The 30% rule is a commonly used guideline for determining housing affordability. It suggests that individuals or households should allocate no more than 30% of their gross monthly income towards rent and related housing expenses.

This percentage serves as a benchmark to help tenants avoid becoming “rent-burdened,” meaning they are spending an excessive portion of their income on housing, potentially limiting their ability to meet other financial obligations or save for the future. While useful, it’s important to understand the 30% rule is a guideline, not a strict rule. Individual circumstances and financial priorities can influence how much rent is truly affordable.

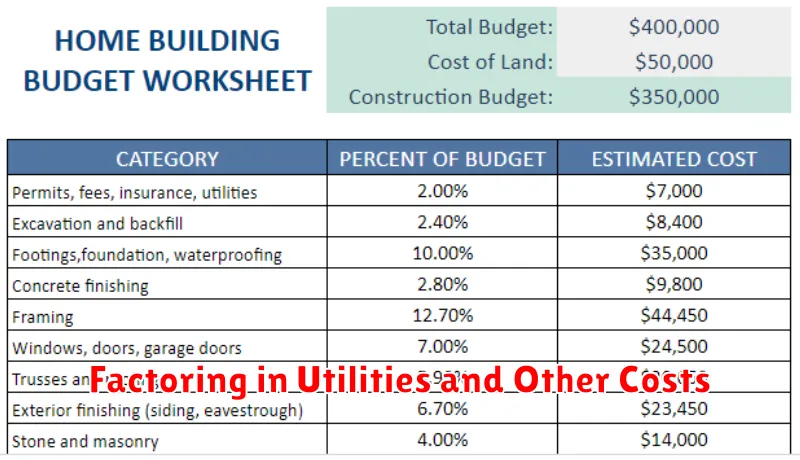

Factoring in Utilities and Other Costs

Beyond rent, utilities significantly impact your monthly expenses. These commonly include electricity, water, gas, and internet/cable. Research average costs in your target area to estimate these expenses accurately.

Other crucial costs to consider are renter’s insurance to protect your belongings and potential parking fees if not included with the rental unit. Also, factor in costs like groceries, transportation, and personal expenses to create a comprehensive budget.

Budgeting Tools and Apps for Renters

Managing finances as a renter can be simplified with various budgeting tools and apps. These resources help track income and expenses, facilitating better financial control. Budgeting apps often categorize spending, highlighting areas for potential savings.

Many tools offer personalized budget creation based on income and expenses. Some apps even provide rent affordability calculators. These calculators help determine a suitable rent range based on your financial situation.

Spreadsheet software like spreadsheet applications can also be effective for budgeting. Creating a customized spreadsheet allows for detailed tracking and analysis of your finances.

Adjusting Expectations Based on Location

Location plays a crucial role in rental costs. Expect higher prices in bustling urban centers and popular neighborhoods with convenient amenities.

Conversely, more affordable options are typically found in suburban areas or locations farther from city centers. Consider commuting times and access to essential services when evaluating affordability in different locations.

Researching median rents in your target area can provide a realistic benchmark for your budget.

Avoiding Financial Strain

Sticking to your budget is crucial for a comfortable tenancy. Exceeding your affordable rent range can quickly lead to financial strain.

Prioritize essential expenses like food and utilities. A common guideline is the 30% rule, suggesting that rent should not exceed 30% of your gross income. However, consider aiming for a lower percentage, especially if you live in a high-cost area or have significant debt.

Building an emergency fund is essential to cover unexpected costs and avoid falling behind on rent. Aim for three to six months of living expenses.

Saving for Emergency Repairs or Moves

Even with responsible landlords, unexpected repairs within your rental unit might arise, necessitating out-of-pocket expenses. A dedicated fund helps cover these costs without straining your budget. Prioritize setting aside a small amount monthly.

Moving also requires substantial funds for security deposits, first month’s rent, and moving expenses. Having savings earmarked for relocation provides flexibility if your lease ends, or your circumstances change unexpectedly.