Are you a renter? Do you have renters insurance? Many renters are unsure if they truly need this type of coverage. Understanding renters insurance is crucial for protecting your belongings and financial well-being. This article explores the importance of renters insurance and helps you decide if it’s the right choice for you. We’ll cover key aspects of policies, including what renters insurance covers, the cost of renters insurance, and the potential consequences of going without. Learn about liability coverage for renters and determine if your landlord’s insurance is enough to protect your personal possessions. Dive into the details of renters insurance coverage to make an informed decision regarding your valuable assets.

Protecting your belongings from unforeseen circumstances is paramount, and renters insurance offers invaluable peace of mind. From fire and theft to water damage and vandalism, understanding the benefits of renters insurance can help you safeguard your possessions. This article will delve into frequently asked questions about renters insurance, helping you determine if you need it and what coverage options best suit your needs. Discover the importance of renters insurance, understand how renters insurance works, and explore the potential cost of renters insurance. By weighing the pros and cons of renters insurance, you can make an informed decision about protecting your belongings and your financial future.

What Is Renters Insurance?

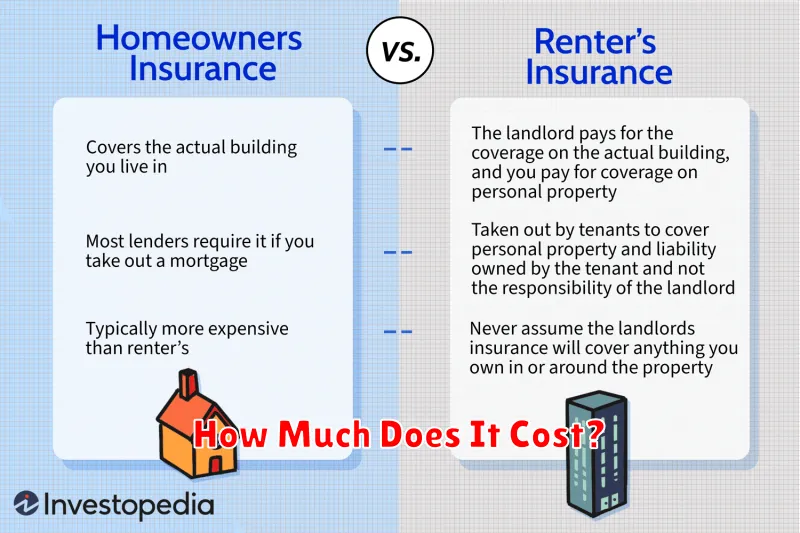

Renters insurance is a type of property insurance that provides coverage for a policyholder’s belongings within a rented property. It protects against losses from events like fire, theft, and vandalism. Unlike a landlord’s insurance policy, which covers the building itself, renters insurance focuses on the tenant’s personal possessions.

Importantly, renters insurance also typically includes liability coverage. This protection can help cover costs associated with legal action if someone is injured on your property and you are found responsible.

What Does It Cover?

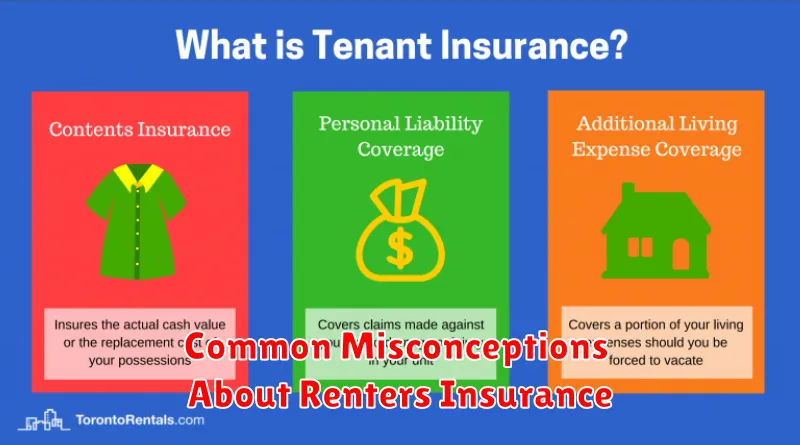

Renters insurance typically covers three key areas: personal belongings, liability, and additional living expenses.

Personal belongings coverage protects your possessions from events like theft, fire, or vandalism. Liability coverage protects you if someone is injured in your apartment and sues you. Finally, additional living expenses coverage helps pay for temporary housing if your apartment becomes uninhabitable due to a covered event.

Is It Required by Landlords?

While renters insurance isn’t legally mandated by governments, many landlords now require it as part of the lease agreement. This protects their property from potential damages caused by tenants.

Requiring renters insurance is becoming increasingly common, shifting the responsibility for personal belongings and liability coverage onto the renter. Check your lease agreement carefully to understand your obligations regarding renters insurance.

How Much Does It Cost?

Renters insurance is surprisingly affordable. The average cost is between $15 and $30 per month. This small cost can provide significant financial protection.

Several factors influence the premium. These include the amount of coverage, the location of the rental property, and the deductible you choose. Higher coverage limits and lower deductibles generally result in higher premiums.

Choosing the Right Policy

Once you’ve decided renters insurance is right for you, the next step is selecting the appropriate policy. Coverage amounts are a key consideration. Think about the total value of your belongings. Would $20,000, $50,000 or more be needed to replace everything?

Also consider your liability coverage needs. This protects you if someone is injured in your apartment. A standard policy usually starts at $100,000, but you might want more. Finally, evaluate different deductible options. A higher deductible means lower premiums but more out-of-pocket expense if you file a claim.

Making a Claim

Filing a renters insurance claim is generally a straightforward process. You’ll need to contact your insurance company as soon as possible after an incident. Be prepared to provide details about the event, including the date, time, and description of the damage or loss.

You’ll likely need to submit documentation, such as police reports (if applicable), photos, and a list of damaged or stolen items. Your insurance company will then assess the claim and determine your coverage. Keep detailed records of all communication and documentation throughout the claims process.

Common Misconceptions About Renters Insurance

Many renters operate under false assumptions regarding renters insurance, leading them to forgo this valuable protection. One common misconception is that their landlord’s insurance covers their belongings. In reality, a landlord’s policy typically only covers the building’s structure, not the renter’s personal possessions.

Another misconception is the belief that renters insurance is expensive. The truth is that renters insurance is generally quite affordable, offering significant coverage for a relatively small monthly premium.

Finally, some renters believe they don’t have enough valuable possessions to warrant insurance. However, replacing everything at once due to a fire or theft can be financially devastating, regardless of perceived value. Renters insurance provides essential financial protection against unexpected events.